When you’re preparing your taxes, you can make deductions on expenses used for business-related meals. After the Tax Cuts and Jobs Act was put in place, people were worried that these deductions couldn’t be made anymore. However, if certain requirements are met, you’re still able to do so.

If you’re confused about meal deductions, David Gallagher and his team can help. Use this overview to familiarize yourself with the topic before you reach out to us.

In order to deduct meal expenses, you must prove that they were used for the sake of business. An example would be if you shared a meal with a client as you discussed how your partnership was developing. Since it was done for the sake of furthering your business, expenses associated with it can be deducted.

Note that only the costs for the meals and beverages are deductible. Any other entertainment-related expenses from a trip like this aren’t deductible. In addition, any extravagant expenses can’t be deducted either. Like with all business deductions, the IRS must consider these expenses both necessary and ordinary.

The amount that is deductible for a certain payment ultimately depends what the money was used for. Some meal expenses are fully deductible, while others are only partially deductible.

For example, the allowable deduction for meals with local clients will differ from the allowable deduction for meals you share with clients while travelling for business. We’ll work with you to show you how much you can deduct so you know what to do when you’re bookkeeping.

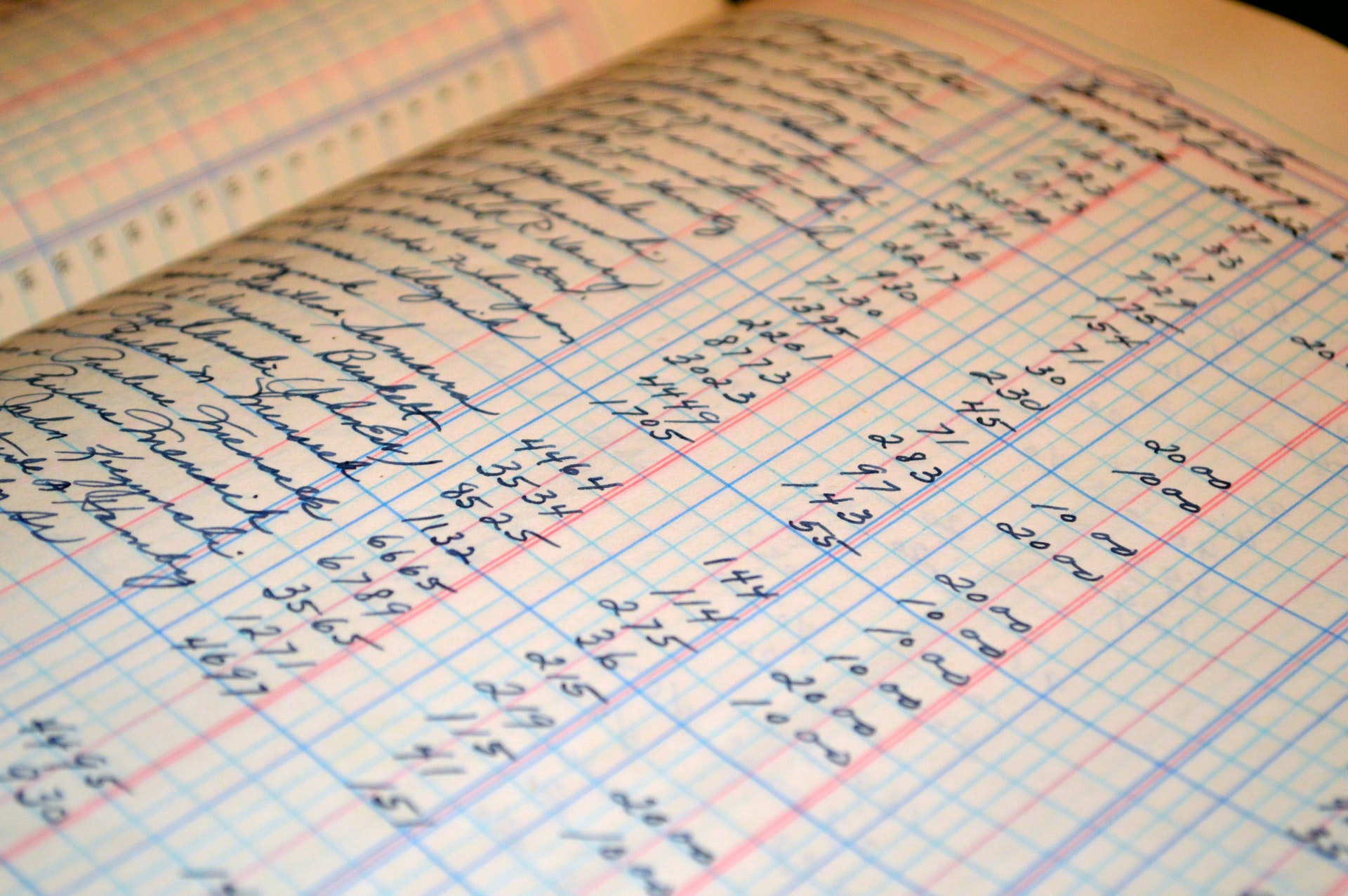

Of course, you’ll need to have certain documentation so the IRS can allow you to make these deductions. Be sure to hold onto any receipts for business meals so you have physical proof of your payments. Hold onto any work-related documents too, so you can show that this meeting was held for business purposes.

You’ll also need to take notes on where you ate, which day the meal took place, and why you met with this other person. Make sure you’re on top of recordkeeping so you don’t miss any pieces of vital information. Missing some of this info can make it harder for you to take deductions.